Society

Quality of service and customer satisfaction

Customers are still at the heart of the bank’s strategy: the goal is for the bank to become the primary financial service provider for its customers through excellent customer relationships. This is the main driver behind the corporate governance activity, the day-to-day operations and the changes implemented.

In 2024, the bank made a business decision affecting its online channels, phasing out and discontinuing its very first internet bank, CIB Internet Bank. This channel served our customers for more than 20 years, and received a special award upon launch, but now, with its outdated technology, it could no longer be developed further.

As this decision affected many long-standing customers of the bank, the bank prepared accordingly to switch to a newly developed, modern online channel. The discontinuation of the old internet banking service introduced new features to the new channels, further enhancing the quality of the bank’s platform. In the case of such and similar business decisions, possible technical outages, and developments, the impact of the measures on customers is very clearly visible, which can be clearly demonstrated in satisfaction surveys.

The bank is committed to conducting ongoing customer satisfaction surveys, mostly in online formats, allowing the respondents to decide when it is convenient for them to respond. Inquiries are most often made via email or push messages to mobile apps, the latter being the result of a 2024 development aimed at increasing responsiveness. We continuously inquire our customers regarding the quality of the services provided by the bank on nearly 300 days of the year with the help of an ‘Instant Feedback Programme’ (in Hungarian ‘Mérce’) that assesses the level of satisfaction immediately after specific touch points between the customer and the bank (so called ‘Moments of truth’). Summing up all the values related to each ‘Moment of truth’, the trend of evaluations is positive for the bank and shows an upward tendency.

Service quality

A high level of customer focus is ensured not only by the training of employees and the incentive system and corporate culture that determine their attitude, but also by the prudent and effective corporate governance system. Within a corporate governance framework developed in full compliance with statutory requirements, the bank identifies the following as key to ensuring a customer-centric approach:

Customers’ values

Supporting innovation and development remains one of the bank’s objectives. In 2024, the bank’s main developments targeted electronic channels, mainly following the discontinuation of the previous internet banking channel.

In today’s world, it is essential for a bank to be able to serve most customer needs electronically by enabling online connectivity. This is also what CIB Bank strives to achieve with its digital solutions, which not only enable customers to access bank accounts and execute the related administrative tasks, but also to apply for new products – credit cards, personal loans, overdraft facilities – remotely, quickly, and securely.

Innovative solutions are also appearing in cash management: most of the bank’s ATMs also offer a cash deposit function, which means that customers are not forced to adjust their cash deposits to the opening hours of branch offices.

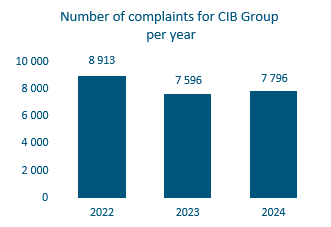

The number of branches operating in a renewed environment under the new model continued to increase in 2024, with the bank opening its largest new branch in Budapest at the Bem Centre, bringing the total number of renovated branches to 10 by the end of 2024. In January 2025, the Allee Branch was modernised, and in the summer of 2025, the new Tatabánya Branch will be opened, whereby the new design will have been implemented in 12 out of the 58 branches. The bank strives for full legal compliance in managing incoming complaints. In addition to legal compliance, it is worth noting that the bank investigates all complaints with a customer-centric approach. In 2024, the number of customer complaints received by the Bank Group was like that in 2023, which is a success considering the decision related to the closure of the old internet banking channel.

In the first months of 2024, complaints mainly concerned dissatisfaction following the discontinuation of the former CIB Internetbank, which was further aggravated by the more difficult accessibility of CIB24. To support a seamless transition, the bank began introducing its new channels — CIB Bank Online and CIB Business Online — as early as 2017. The longer-than-usual waiting times experienced by customers throughout the year were difficult to accept, as they had not been accustomed to this in previous years. To mitigate these negative experiences, the bank decided to expand capacities, with the effects already becoming slightly noticeable by late 2024. However, a large proportion of the bank’s customers were extremely satisfied with the services provided by the professionally trained telephone bankers, whose helpfulness and commitment also generated a great deal of positive feedback in internal surveys.

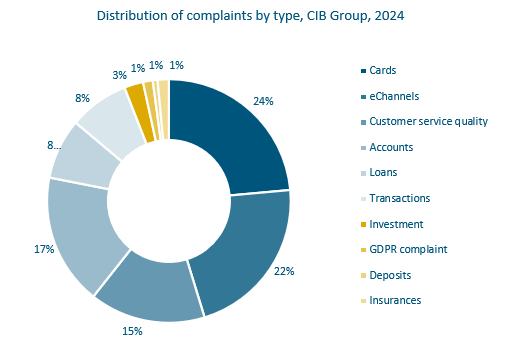

One of the reasons for the increase in card-related complaints is the rise in phishing and fraud. The card replacement process necessary e.g. after phishing is lengthy, the physical card gets lost in the post, the PIN code fails to arrive. This problem was solved by an upgrade called PIN by Digital in mid-2024, making the PIN code available in the CIB Bank mobile application. The mailing of replacement cards has also been revamped, with faster dispatch reducing the replacement process turnaround time (from 10-14 days to 5-7 days).

In the case of transactions, there has been an increase in transfer-based phishing fraud, which also increased the number of related complaints. In 2024, 198 complaints were received, compared to 117 in 2023 and 63 in 2022. In the second half of the year, a new method of successful fraud emerged, whereby fraudsters logged into the customer’s CIB Bank mobile application (having obtained the login details from the customer) and designated as ‘trusted partner’ a target account they had set up, then initiated transfers to that account with a #withKey token approval, with no traditional approval being necessary, which the customers granted in large numbers. This feature was discontinued on 8 November 2024. On 9 December 2024, restrictions were also imposed on the CIB Bank Online channel. On 6 December 2024, in accordance with the supervisory anti-fraud recommendation, daily and monthly basic transaction limits and maximum limits were applied to digital channels.

The number of complaints related to bank accounts increased in 2024 due to a failure to set discounts. One example is the Welcome customer referral programme: in the event of incorrect registration or failure to register, the promotional amount will not be credited, which in many cases is due to inaccurate/incorrect information provided by the branch.

Customer protection and responsible sales

For CIB Bank, it is of utmost importance to provide its customers in payment difficulties and those who have fallen into payment arrears with appropriate information and to find a solution together. Therefore, in case of payment delays, the bank contacts its customers through various channels (by post or, subject to their consent, by SMS, telephone, or e-mail) to find a solution together. The bank may also contact its customers in person through an agent, informing them by post of the identity and contact details of the agent, prior to contacting them. To find a solution for its customers as soon as possible, the bank requests its customers to report as soon as possible, preferably before the payment default occurs, if there is a negative change in their solvency. Payment facilitation solutions are also available if customers are in arrears or if they have paid their instalments on time so far but expect payment difficulties in the future.

In negotiating with the customer, the bank will seek to maintain the original terms of contract, and our employees will also provide information on other payment facilitation and restructuring options involving contract renegotiation. The bank provides both short-term (temporary) and long-term (contract amendment-based) solutions to help its customers manage the payment delay.

- As a temporary solution, the bank offers its customers a grace period or an instalment repayment agreement to settle the overdue debt.

- For loans secured by real estate: maturity extension, payment facilitation;

- For loan products not secured by real estate (personal loans, overdraft facilities, credit cards, shopping cards): maturity extension, debt settlement.

Key elements in a responsible customer relationship

Responsible marketing

The CIB Group supports the achievement of strategic goals with the visual appearance and slogan used in its marketing materials. Existing and potential customers become aware of the bank's products and services through marketing activities. It is important for the bank to provide clear and accurate information in a way that generates interest in its products and services.

The marketing communication materials will be finalised after the legal and compliance departments have reviewed them, to ensure responsible operation and full legal compliance. The bank takes both ethical and sustainability guidelines into account in the campaigns. The CIB Group does not advertise in media that provide a platform for the expression of any extreme views.

In line with the goal of responsible communication with the customers, and in compliance with the statutory provisions, the bank does not recommend our products to minors, and it does not advertise in public institutions where the education and training of young people under the age of 18 takes place. The certificate from the Self-Regulatory Advertising Board on advertising self-regulation can be found among the appendices. The bank considers the principles of diversity and inclusion in its marketing communication activities. A process of environmentally responsible marketing communication activities was implemented from the summer of 2023, during which the bank continuously applies guidelines to be followed during media buying, production, event management and the purchase of promotional gifts.

Customer health and safety

CIB Bank protects the health and safety of its employees and all the people in all its head offices and branches. For this purpose, the bank has the necessary safety and operational regulations in place. In branches where there was a need and opportunity for this, protective plexiglass remained in place at customer service counters, and hand sanitiser was also available on request.

Innovation, digital transition, and cybersecurity

Another important aspect is the Group’s ability to meet its customers’ needs through an operational structure that offers simple solutions, tailored to these needs, and focused on IT security and the physical security of customers – also thanks to the continuous reinforcement of the controls implemented – while maintaining a responsible and transparent approach in terms of the Group’s relationships with its customers.

Performance indicators and results achieved

In the retail segment, CIB Bank aims to increase the volume of lending by developing the various sales channels, particularly the mobile app, the internet banking platform and the online product-application processes that are available through the website. In the area of premium banking services, the aim is to continuously expand the offering, and to provide high-standard asset management and insurance products and excellent, standardised banking services through the electronic channels and the branch network. While one of the primary objectives of the strategy remains to serve the needs of Generation Y (born between 1980 and 1994), the bank is now also serving Generation Z (born between 1995 and 2009) and even Generation Alpha (born between 2010 and 2024) with the latest members of the ECO account family, while also playing a role in the financial and digital education of the younger generations. CIB Bank is looking to expand its activities in this area by developing new digital products and services and through cooperation with institutions of higher education (No cooperation with institutions of higher education took place in 2024).

Part of CIB Bank’s business strategy is to strengthen the corporate segment’s market position by acquiring new customers and increasing business volumes. By upgrading the corporate internet banking and front-end system and by simplifying processes, the aim is for SME and large corporate customers to execute an increased proportion of their payment, deposit, and currency transactions at CIB Bank. There is also a major emphasis on strengthening treasury and documentary services. In addition to the above CIB Group wants to further exploit synergies with its Parent Company, Intesa Sanpaolo S.p.A., to strengthen its presence in the multinational corporate sector.

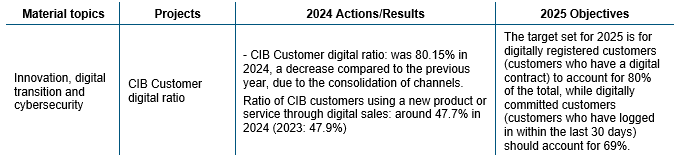

The proportion of retail customers using digital services is expected to reach over 80% by 2025, due to the closure of the old Internet Bank channel and the consolidation of channels.

CIB Bank has laid the foundations for ESG-conscious lending by setting up a dedicated team specifically focused on this topic, laid down key principles and added ESG rating elements to its data set, whereby it can now support its customers on this topic and create a transparent ESG strategy as well.

The bank continuously strives to reduce any negative environmental and social impacts of its products and services through the following processes.

- Risk management processes

- Decision-making process

- Comprehensive provision of information to stakeholder customers and partners

- Simplification

- High degree of advertising self-regulation

The digitalisation processes paving the way towards an integrated multichannel bank

Digital transition is measured by the bank using the following two performance indicators:

- CIB Customer digital ratio was 80.15% in 2024 (2023: 84.1%), a decrease compared to the previous year, due to the consolidation of channels.

- The ratio of CIB Bank’s customers using a new product or service through digital sales was 47.7% in 2024 (2023: 47.9 %).

As for the proportion of users of digital services, with the phasing out of CIB Internet Bank, inactive customers who only used this channel were not included in the aggregated data. It is difficult to increase the use of additional digital services within the existing customer base. Growth can only be achieved by increasing the number of new customers and opening new accounts.

Responsibility towards the supply chain

Responsible procurement is a key pillar of the CIB Group’s operations. Therefore, the bank’s most important core principle when choosing suppliers is to display fairness and transparency in the selection process, which is thus based on the joint application of tendering and negotiation. This is why it is especially important to maintain good supplier relationships that enable continuous dialogue. The objective is to operate an efficient cost management system and procurement process, and to control expenses. The same terms apply to all suppliers, and during their selection the bank enforces the same procurement principles and rules consistently.

CIB Group’s procurement principles are as follows:

- a supplier selection system that ensures transparency and a level playing field;

- consistent and favourable payment terms;

- requiring legal and ethical employment practices from subcontractors as well;

- the use of environmentally friendly technologies, environmentally friendly products and materials, and the recycling of waste is encouraged and in certain cases compulsory.

- taking ESG guidelines into account when selecting suppliers.

The management of suppliers is important for CIB Bank, and covers all activities needed to register and monitor suppliers, and to analyse and assess them based on technical, financial, commercial, environmental and social sustainability factors as well as on organisational considerations and reputational risks, and in terms of how good a fit they are considering the bank’s specific needs.

The Parent Company made the decision to introduce the Supplier Portal (Portale Fornitori) system at the subsidiaries. The future suppliers of CIB Bank have the possibility to register themselves on the portal, providing not only their official data but also specifying the procurement categories that they have experience in. At the same time, it allows CIB Bank to increase its knowledge of its suppliers, both existing and prospective, and to increase the degree of fair market competition between them.

The ISO 50001 guidelines that were previous integrated into our procurement processes (for example, the principle that low-consumption, energy-efficient and sustainable equipment and solutions should be prioritised over high-consumption alternatives during the procurement process) are fully in line with the Rules in Green Banking Procurement which was adopted in 2023. The initiatives under the latter are essentially aimed at protecting the environment. CIB Bank is committed to the responsible sourcing and use of goods and services that comply with the regulations on environmental protection and conservation. The main considerations are energy consumption, CO2 emissions, waste generation, and consumption of materials such as paper, toner and stationery. In keeping with the principles of CIB Bank’s Parent Company, Intesa Sanpaolo S.p.A., ethically sound conduct is reflected in a commitment it insists on in the contracts we conclude with suppliers, which is that the suppliers must confirm, before signing the contract, that they have read the Code of Ethics, understood the parts that relate to them (‘Guiding Principles for our Stakeholder Relationships’ and ‘Guiding Principles for our Supplier Relationships’), that they agree with its contents and that they will fully comply with its provisions in their own operations. At the same time, suppliers can submit reports related to ethical issues at etikaibejelentes@cib.hu.

In addition to the rules regarding ethical behaviour, contracts concluded with all the suppliers of the bank now include paragraphs related to GDPR and anti-corruption, in compliance with the internal policies and the external regulations.

Other key issues are:

- respect for the rights of suppliers (in particular the right to health, safety and non-discrimination);

- respect for human rights throughout the supply chain (in particular the avoidance of suppliers who violate the human rights of their employees or their wider community);

- the inclusion of energy efficiency considerations as a key element of our procurement, refurbishment, and construction plans.

The CIB Group develops and improves its sustainable procurement processes in line with the Intesa Sanpaolo Group’s policies and practices, as well as with expected international and domestic legislative and reporting requirements.

Number of suppliers and value of services purchased by geographical area

Based on data as of 31 December 2024